Financials

Unaudited Interim Results For The Six Months Ended 30 June 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

Announcement Of Unaudited Interim Results For The Six Months Ended 30 June 2024

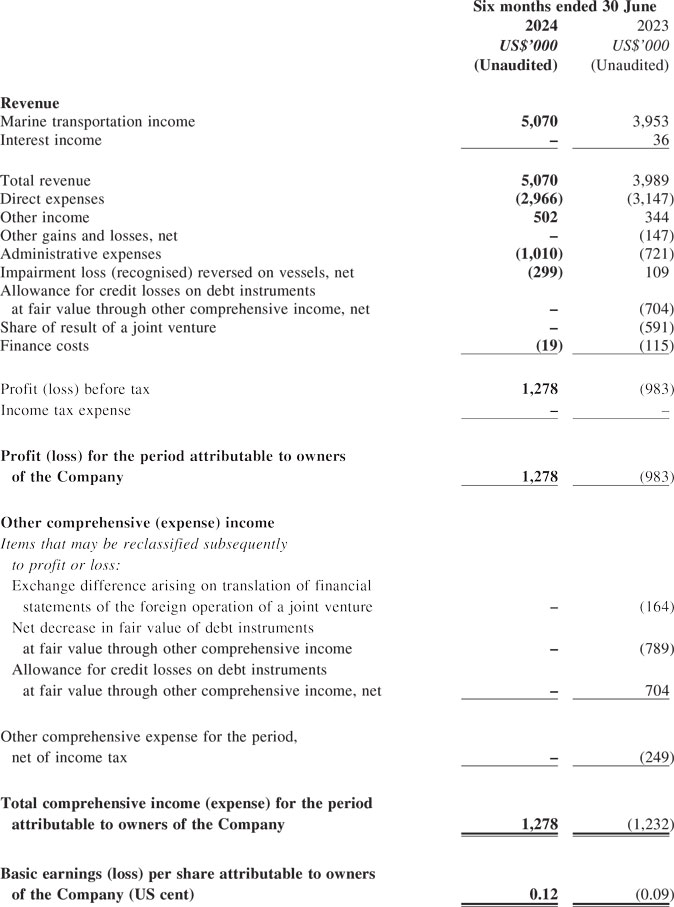

Condensed Consolidated Statement Of Profit Or Loss And Other Comprehensive Income

For the six months ended 30 June 2024

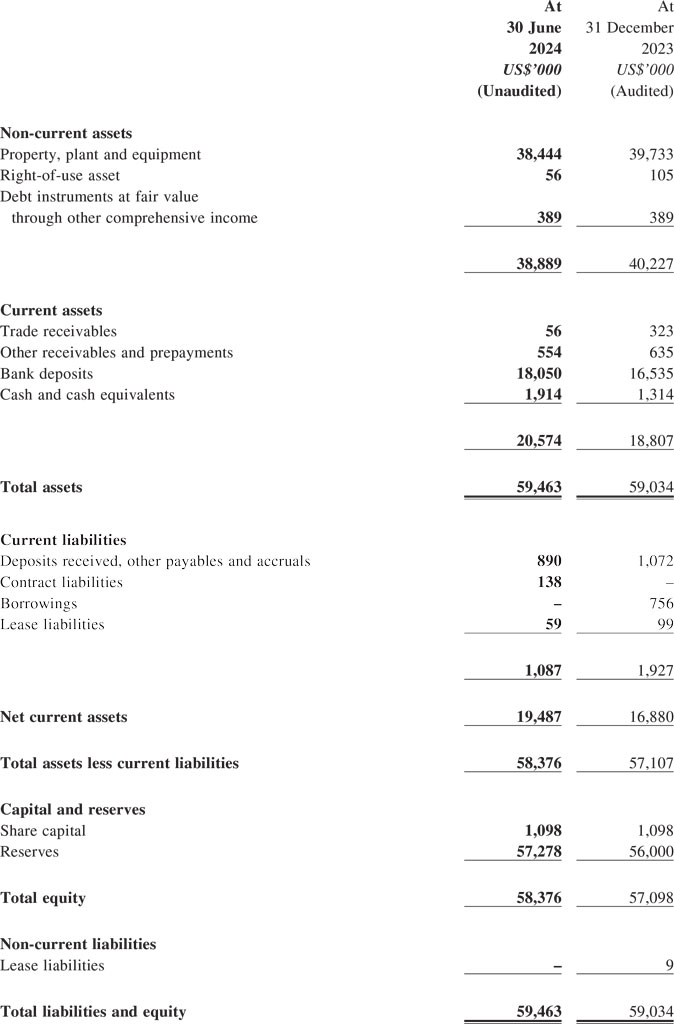

Condensed Consolidated Statement Of Financial Position

At 30 June 2024

OVERALL RESULTS

For HY2024, the Group recorded a profit attributable to owners of the Company of US$1,278,000 (30 June 2023: loss of US$983,000) and a total comprehensive income attributable to owners of the Company of US$1,278,000 (30 June 2023: total comprehensive expense of US$1,232,000). Such turnaround of the Group's results was mainly the combined effect of (i) the increase in profit contribution from the Group's marine transportation operation to US$2,170,000 (30 June 2023: US$796,000); (ii) the absence of the allowance for credit losses on debt instruments at FVTOCI (30 June 2023: US$704,000); (iii) the absence of the loss of a joint venture shared by the Group (30 June 2023: US$591,000) and (iv) the impairment loss recognised on vessels of US$299,000 (30 June 2023: a net reversal of impairment loss of US$109,000).

FINANCIAL REVIEW

Liquidity, financial resources and capital structure

During HY2024, the Group financed its operation mainly by cash generated from operations as well as shareholders' funds. At 30 June 2024, the Group had current assets of US$20,574,000 (31 December 2023: US$18,807,000) and liquid assets comprising bank deposits and cash and cash equivalents totalling US$19,964,000 (31 December 2023: US$17,849,000). The Group's current ratio, calculated based on current assets over current liabilities of US$1,087,000 (31 December 2023: US$1,927,000), was at a strong ratio of about 18.93 (31 December 2023: 9.76) at the period end.

At 30 June 2024, the equity attributable to owners of the Company amounted to US$58,376,000 (31 December 2023: US$57,098,000), an increase of US$1,278,000 from the prior year end and was a result of the profit earned by the Group during the review period.

The Group's borrowings represented loans from a financial institution and were fully repaid during HY2024. At 31 December 2023, such borrowings were mainly applied for financing the holding of vessels, and were all due within one year, denominated in United States dollars, bore interests at floating rates, and secured by two vessels owned by the Group. For HY2024, the Group's finance costs of US$19,000 (30 June 2023: US$115,000) represented mainly interests for the borrowings, finance costs decreased by 83% was mainly a result of the full repayment of borrowings during the period.

At 30 June 2024, the Group's gearing ratio was zero. At 31 December 2023, such ratio, calculated on the basis of total borrowings of US$756,000 divided by total equity of US$57,098,000, was at a low ratio of about 1%.

The Group's interest income from banks increased by 24% to US$385,000 (30 June 2023: US$311,000), which was mainly a result of additional surplus funds on hand and the general rise in bank deposit rates.

With the amount of liquid assets on hand, the management is of the view that the Group has sufficient financial resources to meet its ongoing operational requirement.

Use of proceeds from the Open Offer

In January 2021, the Company successfully raised US$9,148,000 before expenses by way of an open offer of 548,851,784 offer shares (with aggregate nominal value of US$548,851.784) at the subscription price of HK$0.13 per offer share (the closing price of the Company's shares was HK$0.193 on the day when the subscription price was fixed) on the basis of one offer share for every one share of the Company held on the record date (the "Open Offer"). The net proceeds from the Open Offer were US$8,621,000 (equivalent to a net subscription price of approximately HK$0.12 per offer share), of which a sum of US$2,821,000 was utilised as intended to repay a bank revolving loan to achieve immediate saving in finance costs, whilst the remainder of the net proceeds of US$5,800,000 was earmarked as working capital for the Group's marine transportation business. As opposed to the original intention to apply approximately 50% of the remainder of the proceeds to its marine transportation business, approximately 40% to its investment holding business and approximately 10% to its merchandise trading business as working capital, the net proceeds from the Open Offer were not applied as working capital for the Group's merchandise trading and investment holding businesses as the Group was not active in its merchandise trading and investment activities during the period concerned primarily owing to the adverse economic impact brought by the prolonged continuation of the COVID pandemic. The Company has therefore earmarked the remaining net proceeds of US$5,800,000 as working capital for the Group's marine transportation business before any acquisition of a vessel is proceeded with. Such working capital would be continually used and replenished in the course of operation on an ongoing basis.

The management has been evaluating acquisition opportunities of target vessels and it is still the Group's intention to reutilise the remaining net proceeds of the Open Offer of US$5,800,000 to acquire a second-hand dry bulk vessel. Barring unforeseeable circumstances, the Group expects to complete the acquisition of a target vessel within twelve months from the date of this announcement. The management will continue to closely follow the market conditions and will inform shareholders of any update of the vessel acquisition as and when appropriate.

PROSPECTS

The Group is prudently optimistic about the prospects of the marine transportation business in the medium to long term, given that global trading activities have increased alongside the recovery and growth of the global economy. Nevertheless, ongoing conflicts in Ukraine and Palestine, and disruptions in the Panama and Suez Canals, are adding uncertainties to the market.

The Group has yet to acquire a second-hand Supramax or Panamax vessel and is currently evaluating certain acquisition opportunities. The Group will inform shareholders of any update of the vessel acquisition as and when appropriate. Looking ahead, the Group will continue to manage its businesses in a disciplined manner, as well as to explore potential investment and acquisition opportunities and business enhancement strategies which are expected to bring long-term benefits to the shareholders.