Financials

Unaudited Interim Results For The Six Months Ended 30 June 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

Announcement Of Unaudited Interim Results For The Six Months Ended 30 June 2025

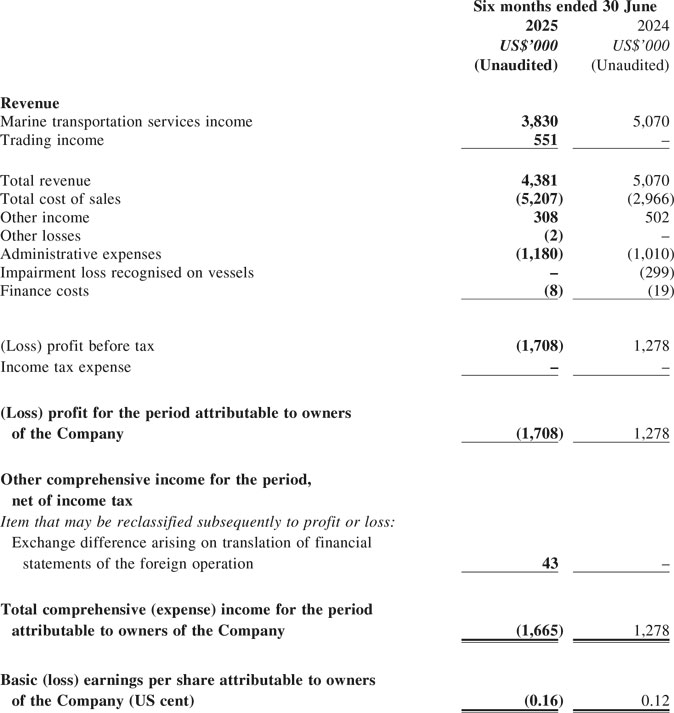

Condensed Consolidated Statement Of Profit Or Loss And Other Comprehensive Income

For the six months ended 30 June 2025

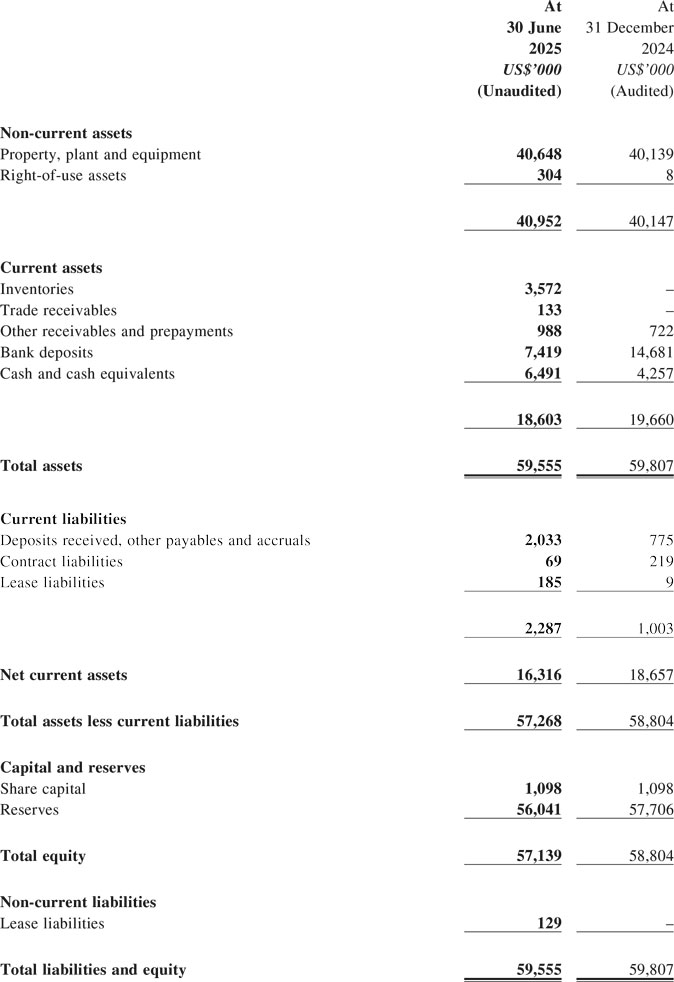

Condensed Consolidated Statement Of Financial Position

At 30 June 2025

BUSINESS REVIEW

During the six months ended 30 June 2025 ("HY2025"), the Group principally engaged in the businesses of marine transportation and trading. Filtering from trade war initiated by the United States and geopolitical conflicts, Baltic Supramax Index 58 ("BSI 58") plunged 34.1% year-on-year, which exerting to significant pressure on the Group's marine transportation business within the review period. In HY2025, the Group reported a reduction in revenue by 14% to US$4,381,000 (30 June 2024: US$5,070,000), a decrease of US$689,000, and recorded a loss attributable to owners of the Company of US$1,708,000, against a profit attributable to owners of US$1,278,000 in the prior period. Basic loss per share for the period was US0.16 cent (30 June 2024: basic earnings per share of US0.12 cent).

The market conditions of the Group's marine transportation had been under significant pressure with Supramax dry bulk charter rates declining 34.1% year-on-year during the period under review. This downturn stemmed from weaker commodities demands and the oversupply of vessels caused by escalation of trade war tensions between the United States and other countries and ongoing geopolitical conflicts in Ukraine and Palestine. To mitigate the cyclical effect of marine transportation business, the Group strategically resumed its trading business in HY2025.

Marine transportation

The carrying capacity of the Group's dry bulk fleet, which currently comprises three Supramax size bulkers, is approximately 171,000 dwt.

The BSI 58 slumped to its 5-year trough of approximately US$5,600 per day in February 2025. Average BSI 58 had been US$9,202 per day in HY2025 and plunged to average US$4,773 per day against the same period last year. In addition, there had been decrease of approximately US$300,000 in revenue due to regular dry-docking of one of the Group's bulkers, MV Heroic in HY2025.

Trading

Capitalising on the new controlling shareholder's extensive experience and business networks in coal and commodities, the Group has expanded into coal trading in HY2025. The Group recorded sales revenue of US$551,000 (30 June 2024: nil) and a profit of US$13,000 (30 June 2024: nil) during the period. During HY2025, the Group recorded coal trading of 5,200 tons (30 June 2024: nil).

FINANCIAL REVIEW

Liquidity, financial resources and capital structure

During HY2025, the Group financed its operation mainly by cash generated from operations as well as shareholders' funds. At 30 June 2025, the Group had current assets of US$18,603,000 (31 December 2024: US$19,660,000) and liquid assets comprising bank deposits and cash and cash equivalents totalling US$13,910,000 (31 December 2024: US$18,938,000). The Group's current ratio, calculated based on current assets over current liabilities of US$2,287,000 (31 December 2024: US$1,003,000), is lowered, but it was still at a strong ratio of about 8.1 (31 December 2024: 19.6) at the period end. The decrease in current ratio was mainly attributed to the provision of dry-docking costs during the review period, which in turn led to the increase in current liabilities.

At 30 June 2025, the equity attributable to owners of the Company amounted to US$57,139,000 (31 December 2024: US$58,804,000), decreased by US$1,665,000 (30 June 2024: increased by US$1,278,000) when compared with the prior year end and was mainly a result of the loss incurred by the Group of US$1,708,000 (30 June 2024: profit earned of US$1,278,000).

For HY2025, the Group's finance cost of US$8,000 (30 June 2024: US$19,000) represented by an interest portion of lease liabilities. For the six months ended 30 June 2024, such finance cost represented mainly interests for the borrowings which were fully repaid by the end of 30 June 2024.

The Group's interest income from banks decreased by 53% to US$182,000 (30 June 2024: US$385,000), which was mainly resulted from the general decline in bank deposit rates.

With the amount of liquid assets on hand, the management is of the view that the Group has sufficient financial resources to meet its ongoing operational requirement.

PROSPECTS

As the trade war has gradually been softening and Sino-US tariff negotiations has been progressing, the Group's management remains cautiously optimistic about the medium- to long-term prospects of its marine transportation businesses.

Since June 2025, BSI 58 has rebounded strongly. Given the demand in commodities has gradually gaining momentum, the Red Sea crisis has remained lingering and the global marine transportation bulkers supplies have yet to be effectively alleviated, the Group expects demands on bulkers remain strong in the near term.

The Group has been continuously leveraging on the extensive and diverse business resources of its new controlling shareholder, business partners, and other stakeholders to expand its logistics and trading businesses in mainland China, Mongolia, and other Belt and Road countries, striving to cultivate new growth drivers and achieve business diversification.

Looking ahead, the Board maintains its prudent business philosophy in seizing opportunities to expand its fleet, levelling up its professionalism in fleet management, implementing refined cost-cutting and efficiency-enhancing measures, and exploring investment and merger and acquisition opportunities, aiming to deliver long-term growth to the shareholders of the Company.